1 Which of the following best describes supply-side economics. Week 7 Quiz 5.

Demand Side Vs Supply Side Economics Theories Differences Video Lesson Transcript Study Com

Increases in social security taxes and other business taxes shift the aggregate supply curve to the right.

. Supply-side economics is a macroeconomic school of thought that falls under the classical theory of economics. A Labor productivity affects aggregate supply. Tax cut give more money to investors and consumers which leads to overall economic growth.

Unit costs are rising rapidly as firms are producing beyond their capacity. High marginal tax rates severely discourage work saving and investment. C Education affects the incentive to work save and invest and therefore aggregate supply.

Supply-side economics is the theory that says increased production drives economic growth. Up to 256 cash back Get the detailed answer. C The government establishes production goals for businesses which leads to higher-priced goods.

Lower taxes on research and development of new technology. Higher taxes on household income. Education impacts labor productivity which impacts aggregate supply O C.

Increasing productive capacity Question 2 3 out of 3 points Pharmaceuticals food and other necessities would be good performers during the ____ stage of the business cycle. 1 Which of the following best describes supply-side economics. Which statement best describes supply-side economics.

Economy A AS B. Supply-side fiscal policy focuses on creating a better climate for businesses. C Education affects the incentive to work save and invest and therefore aggregate supply.

Which of the following best describes supply-side economics. Supply-side economics is a theory stating that production or supply of goods and services is key to the determination of economic growth. Has no effect on economic growth.

Which best describes supply side economics. Choose the one alternative that best completes the statement or answers the question. Supply-side economics is an economic theory that postulates tax cuts for the wealthy result in increased savings and investment capacity for them that trickle down to the overall economy.

Which of the following statements best describes the supply side of Economy A. This theory suggests that economic progression can be made more. Which of the following best describes supply-side economics.

Tax increases encourage borrowing from Banks which leads to great. Which of the following policies best describes supply-side fiscal policy. In contrast demand-side economics focuses on the average consumer to help stimulate the economy again.

B Education impacts labor productivity which impacts aggregate supply. A Labor productivity affects aggregate supply. B Tax rates particularly marginal tax rates affect the incentive to work save and invest and therefore aggregate supply.

Tax rates affect the incentive to work save and invest and therefore aggregate supply B. Unit costs are rising but fims can produce more output by employing standby capacity and overtime labour for example with no increase in the price level. These two economic theories also differ in who receives tax cuts to encourage spending.

Labor productivity impacts aggregate supply D. Which of the following best describes supply-side economics. For example supply-side economics focuses on encouraging businesses and wealthy individuals to spend money.

B Education affects labor productivity which affects aggregate supply. Emphasis on who receives tax cuts. Which of the following best describes supply-side economics.

1 Which of the following best describes suppl y-side economics. Advocates of supply-side economics argue that spending by the federal government _______. Transfer payments increase incentives to work.

Can crash the economy completely. Tax increases encourage borrowing from Banks which lead to greater purchasing power. 43 _____ A Education affects the incentive to work save and invest and therefore aggregate supply.

Tax rates affect the incentive to work save and invest and therefore aggregate supply O B. Education impacts labor productivity which impacts aggregate supply C. A Tax increases encourage borrowing from banks which leads to greater purchasing power.

The government establishes production goals for businesses which lead to higher price goods. Labor productivity impacts aggregate supply O D. Its tools are tax cuts and deregulation.

FIN320 Question 1 3 out of 3 points Supply-side economics tends to focus on _____. B Tax cuts give more money to investors and consumers which leads to overall economic growth. Which of the following best describes supply-side economics.

More extensive government social welfare programs. An increase in the money supply. A Labor productivity affects aggregate supply.

Up to 256 cash back Get the detailed answer. Increasing productive capacity Correct Answer. B Education affects labor productivity which affects aggregate supply.

Helps stimulates economic growth. The factors of production are capital labor entrepreneurship and land. Education impacts the incentive to work save and invest and therefore.

This theory uses the government tools of tax cuts and deregulation to create a better business climate focusing on improving the quality and quantity of production factors including labor capital land. Which one of the following statements is correct under the theory of supply-side economics. A Education impacts the incentive to work save and invest and therefore aggregate supply.

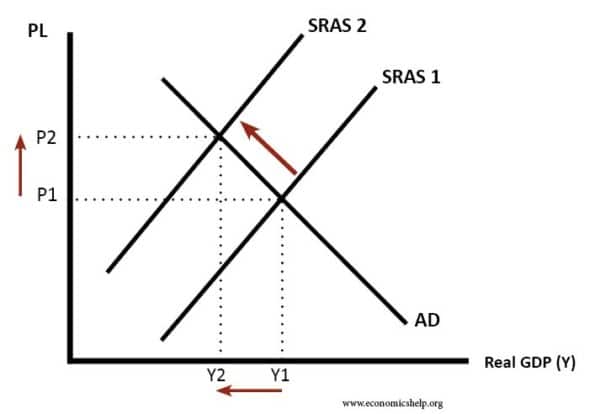

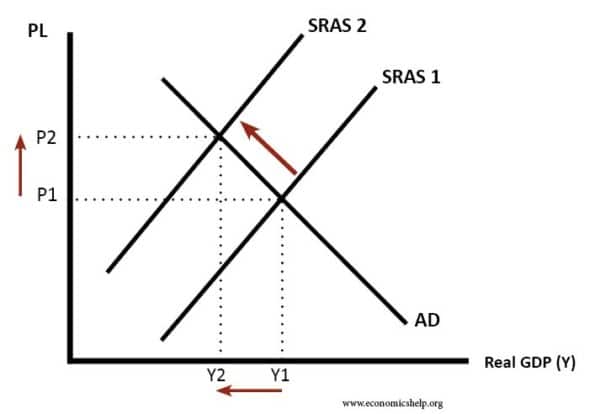

The Role Of Supply Side Policies In A Recession Economics Help

Macroeconomics James B Wilcox Resources Provided By Ppt Download

/supply_curve_final-465c4c4a89504d0faeaa85485b237109.png)

/Supplyrelationship-c0f71135bc884f4b8e5d063eed128b52.png)

0 Comments